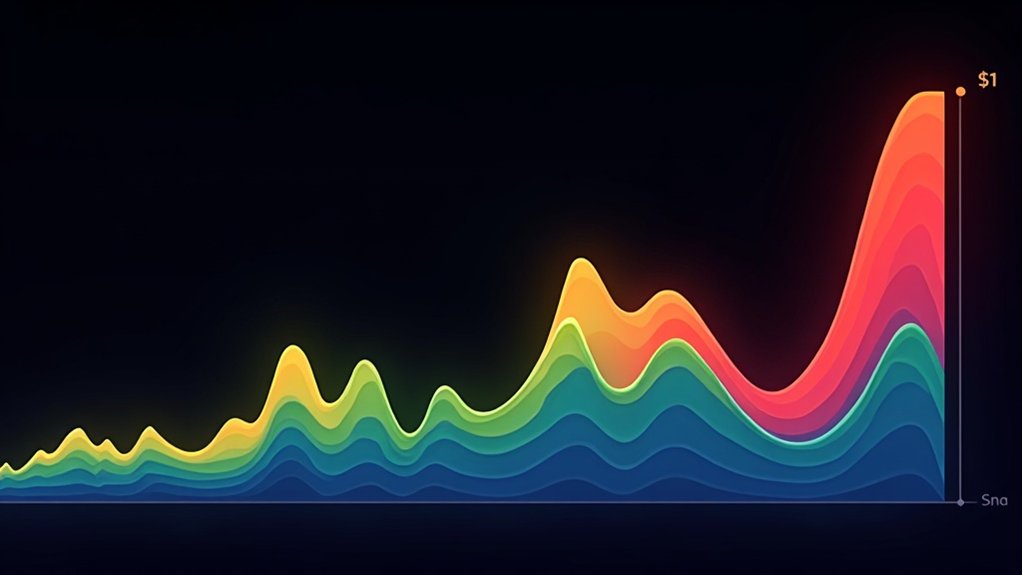

Bitcoin started with no formal value in 2009. Zero. Nada. The first recorded price was a measly $0.003 per coin in March 2010. That famous pizza purchase? 10,000 BTC for two pizzas, valuing each coin at about $0.003. By late 2010, prices crawled to $0.10-$0.30, before skyrocketing 8,000% to $30 in 2011. Then it crashed to $2. Bitcoin’s wild ride was just getting started.

From mathematical concept to pizza currency to speculative asset.

Bitcoin’s birth was quiet, almost unnoticed by the financial world.

Satoshi Nakamoto registered bitcoin.org in August 2008, dropped the whitepaper on Halloween that year, and launched the network on January 3, 2009.

Bitcoin’s origin story: a domain, a whitepaper, and a genesis block. No marketing campaign, just revolutionary code.

No fanfare.

No price tag.

Just a genesis block with 50 BTC and a vision.

Bitcoin had no formal value in 2009.

Zero.

Zilch.

It was passed between tech nerds like digital baseball cards.

The 2008 financial crisis was fresh.

Banks were the enemy.

Bitcoin was the rebellion.

When Nakamoto sent Hal Finney 10 BTC in January 2009, it wasn’t a financial transaction – it was a proof of concept.

Building upon earlier digital currency concepts like bit gold, Bitcoin introduced revolutionary features for secure, decentralized transactions.

The first recorded price finally appeared on March 17, 2010: a laughable $0.003 per bitcoin.

That’s right, less than a penny.

Then came the pizza.

On May 22, 2010, some guy named Laszlo Hanyecz paid 10,000 BTC for two pizzas.

Do the math – that’s about $0.003 per coin.

Those pizzas would be worth hundreds of millions today.

Hope they were tasty.

Things started getting serious when Mt. Gox launched in July 2010.

By year’s end, Bitcoin had climbed to between $0.10 and $0.30.

Not exactly retirement money, but a massive percentage gain.

2011 brought the first real price explosion.

Bitcoin surged over 8,000%, hitting $30 before crashing back to $2.

Classic Bitcoin.

Silk Road’s launch that year didn’t hurt demand either.

Nothing like a darknet marketplace to boost your cryptocurrency’s use case.

The November 2012 halving changed the game.

Mining rewards dropped from 50 to 25 BTC, making each coin more scarce.

Media attention grew.

Infrastructure developed.

Bitcoin increasingly attracted tech-savvy individuals and libertarians who were drawn to its decentralized nature and potential to operate outside traditional banking systems.

The collapse of Mt. Gox exchange in 2014 was a major setback, resulting in the devastating loss of 850,000 Bitcoins.

Frequently Asked Questions

How Do Bitcoin Halving Events Affect Its Price?

Bitcoin halvings historically trigger price increases, though not immediately.

The math is simple: same demand, half the new supply equals higher prices.

After the 2012, 2016, and 2020 halvings, BTC eventually skyrocketed, hitting new all-time highs months later.

It’s partly economics, partly psychology.

Speculators pile in, media coverage intensifies, and FOMO kicks in.

But timing? Unpredictable.

The market doesn’t follow a neat schedule, no matter what crypto bros claim.

What Caused the Major Bitcoin Price Crashes Throughout History?

Bitcoin’s major crashes stem from four main factors.

Exchange hacks, like Mt. Gox’s epic 2011 failure, sent prices plummeting 99.9%.

Government crackdowns – China’s repeated bans caused 50%+ drops.

Good old-fashioned market bubbles popping, like December 2017’s 45% nosedive from $20,000.

And then there’s macro disasters – COVID-19 triggered a 40% collapse as everyone scrambled for cash.

Bitcoin might be revolutionary, but it’s not immune to human panic or regulatory hammers.

How Does Bitcoin’s Price Volatility Compare to Traditional Investments?

Bitcoin’s volatility has historically dwarfed traditional investments.

Once a wild roller coaster at 6-8% daily swings, it’s gradually calmed down.

Still roughly 3.6 times more volatile than gold and 5.1 times more than global equities.

But here’s the kicker – its 90-day volatility in late 2023 was actually lower than 92% of S&P 500 stocks.

The rebel’s growing up, folks.

Bitcoin’s maturing, but don’t mistake it for a boring blue chip just yet.

Can Government Regulations Significantly Impact Bitcoin’s Value?

Government regulations absolutely impact Bitcoin’s value—sometimes dramatically.

China’s 2013 ban triggered an immediate price crash. No surprise there.

When countries crack down, Bitcoin tumbles; when they embrace it, values climb.

The 2024 ETF approvals sent prices soaring by legitimizing Bitcoin for institutional investors.

Markets react instantly to regulatory whispers, rumors, and announcements.

Bitcoin may be decentralized in theory, but in practice? Government policies still push it around like any other asset.

What Role Do Institutional Investors Play in Bitcoin’s Price Movements?

Institutional investors massively influence Bitcoin prices.

They’ve accumulated over 1.86 million BTC by 2025—reducing available supply while driving prices up.

Companies like MicroStrategy (>125,000 BTC) and Tesla (>40,000 BTC) hoard significant portions.

Their presence stabilizes the market, dampening wild swings that once defined crypto.

Bitcoin ETF approvals triggered a 60% price surge in just two months.

Funny how the rebels’ currency now dances to Wall Street’s tune.

Markets don’t lie—institutional money moves Bitcoin.