The Bitcoin Lightning Network is a layer-2 solution that tackles Bitcoin’s glacial transaction speeds. Created in 2015, it lets users establish payment channels to transfer BTC instantly—no ten-minute confirmation wait. It’s like opening a tab at your favorite bar. Transactions happen off-chain through interconnected nodes, drastically reducing fees. El Salvador’s already saving millions with it. Got 16,100+ nodes running now. Still has issues—locked funds, complex routing—but it’s making Bitcoin actually usable for coffee runs.

Why would anyone wait ten minutes for a coffee purchase to clear?

That’s the problem Bitcoin’s main chain presents.

The original cryptocurrency might be revolutionary, but it’s painfully slow.

Like watching paint dry while paying premium fees for the privilege.

Enter the Lightning Network.

Proposed in 2015 by Joseph Poon and Thaddeus Dryja, this layer-2 solution tackles Bitcoin’s notorious scalability problem.

Bitcoin processes roughly 7 transactions per second.

Pathetic compared to Visa’s thousands.

Lightning changes the game by moving transactions off-chain.

The mechanics are clever.

Two parties create a payment channel by locking Bitcoin into a multisignature address on the blockchain.

Think of it as opening a tab at your local bar.

Once open, they can conduct unlimited transactions between themselves instantly.

No waiting.

No ridiculous fees.

Just fast, cheap transfers.

When they’re done, they close the channel.

Only then does the final balance hit the blockchain as a single transaction.

One entry instead of hundreds.

Efficient.

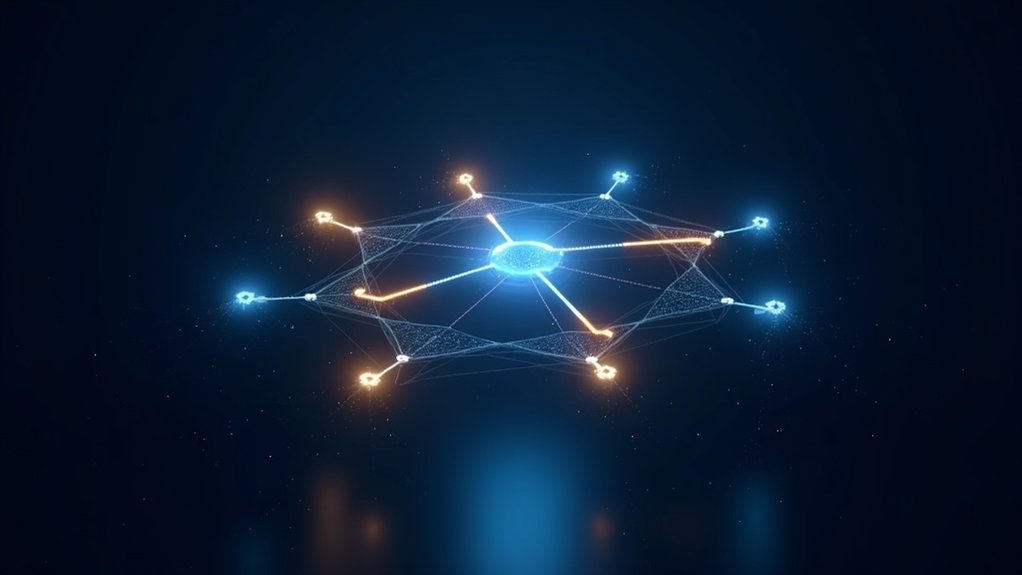

But Lightning isn’t just about two-party channels.

The real magic happens in the network.

Channels connect to form a web, allowing payments to route through intermediary nodes.

Alice can pay Charlie without having a direct channel, routing through Bob instead.

The system uses cryptographic tricks to guarantee funds reach their destination without anyone stealing them along the way.

This interconnected structure makes Lightning perfect for micropayments.

Users can now send Bitcoin as easily as email using Lightning Addresses that work just like familiar email-style identifiers.

Tipping content creators, buying coffee, or sending small cross-border payments become practical again.

Twitter and platforms like Paxful have already integrated it.

El Salvador has embraced this technology as part of their Bitcoin adoption, potentially saving millions in fees annually for their citizens.

The network’s ecosystem continues to grow, with over 16,100 online nodes supporting the infrastructure as of early 2023.

The technology isn’t perfect.

It’s complex.

Channels require funds to be locked up.

Routing can be challenging.

But it solves a fundamental problem.

Bitcoin’s main chain was never designed for buying coffee.

Lightning makes everyday transactions possible.

Fast, cheap, scalable.

That’s what adoption needs.

Not ten-minute confirmation times and five-dollar fees for a three-dollar latte.

That’s just stupid.

Frequently Asked Questions

Can Lightning Network Transactions Be Traced Like Regular Bitcoin Transactions?

No, Lightning Network transactions can’t be traced like regular Bitcoin transactions.

They’re encrypted end-to-end and routed through multiple nodes using onion routing.

Only channel openings and closings appear on-chain—not individual payments.

Intermediary nodes only see previous and next hops, never the full path.

Pretty clever design, actually.

While timing attacks are theoretically possible, practical traceability is greatly limited.

Regular Bitcoin? Public ledger. Lightning? Private channels. Big difference.

What Happens if a Lightning Network Node Goes Offline?

When a Lightning Network node goes offline, it’s basically a traffic jam. Channels connected to that node can’t process payments until it reconnects.

Scary part? If offline too long, there’s risk of fraud—counterparties could broadcast outdated states.

Node operators lose routing fees and potential income.

Watchtowers can help monitor channels when users are offline.

With so many nodes on centralized cloud providers, widespread outages are a real concern.

Network reliability takes a hit. Not great.

How Much Does It Cost to Open a Lightning Channel?

Opening a Lightning channel costs whatever Bitcoin’s network fee happens to be at the moment—anywhere from a few cents to several dollars depending on blockchain congestion.

Typical transactions run about 250-400 bytes.

Then there’s the capital cost—Bitcoin you’re locking up in the channel that you can’t use elsewhere.

Not free, obviously.

Some wallets might add their own fees too.

Channel closing? That’ll cost you another on-chain fee later.

Is Lightning Network Compatible With Hardware Wallets?

Yes, Lightning Network is becoming compatible with hardware wallets, but it’s still a work in progress.

Ledger and Trezor are exploring integration options.

The concept works by delegating transaction signing to the hardware device, keeping private keys secure from malware.

Experimental projects are adapting popular Lightning wallets like Phoenix to work with hardware security.

It’s not seamless yet—early stages and all that.

But for folks handling serious Bitcoin, the added security is worth the wait.

Can Lightning Network Payments Be Used for Recurring Subscriptions?

Yes, Lightning Network fully supports recurring subscriptions.

Services like CoinCorner offer scheduled payments on daily, weekly, monthly or yearly cycles.

New protocols like Nostr Wallet Connect make subscription billing seamless.

Lightning Addresses—those email-like identifiers—eliminate complex invoices, making repeat payments effortless.

Merchants can set up automated billing through tools like ZapPlanner and PayWithFlash.

The network’s Offers feature creates reusable invoices perfect for subscriptions.

Pretty convenient, actually.